In retirement planning, you will need to make decisions about your investments and where to invest your savings so that you can enjoy a comfortable lifestyle throughout retirement.

There are several sources for retirement income, including:

- Registered Retirement Savings Plans (RRSPs)

- Tax-free Savings Accounts (TFSAs)

- Investment accounts (not retirement specific)

- Bank accounts

- Lines of credit (usually based on your home equity)

For most of these forms of income, you will have to invest the balance of your account in order to gain anything. In order to do this yourself, you would need a reasonable understanding of the different investments and how to maximize their value over time.

Relying solely on financial advisors (such as banks) without understanding how your money is being invested is common, but it can have detrimental results.

Investment Funds

Investment Funds are any account that gives you a rate of return (interest on your balance). There are numerous types of funds for investments, but the following are the major categories for individual investors:

|

General Yield |

Risk Level |

Investment Type |

Best for |

Stipulation |

| Short-term investments and GICs |

1-2% per year |

Low |

Government based

Based on inflation rate |

Someone closer to retirement but has a high account balance |

GICs can be long-term where you must leave your money in the account for a certain period of time. |

| Bonds |

2-3% per year |

Medium |

Government-based

Based on inflation rate |

Someone closer to retirement but needs a higher rate of return (lower balance) |

|

| Balanced funds |

4-5% |

Medium |

Combination of bonds and equities |

Someone in their 50s who wants a higher rate of return but can’t afford to keep the money in their account for a long time |

|

| Canadian equities |

4-6% |

High |

Company stocks in Canadian companies |

Someone who can keep the funds in their account for a while (20-40s) to see the higher rate of return |

Would need to keep your funds in this type of account for 5 years or more to enjoy the expected return |

| US & Foreign equities |

4-6% |

High |

Company stocks in foreign companies

Includes foreign exchange fluctuations |

Someone who can keep the funds in their account for a while (20-40s) to see the higher rate of return |

Would need to keep your funds in this type of account for 5 years or more to enjoy the expected return |

When choosing between Canadian, US or Foreign equities, it's worth looking at how the global economy is fairing compared to the Canadian economy and the expected change in exchange rates over time.

In some reports, we will ask you what type of fund you invest in. We will refer to this table to use default rates of return based on your answer.

In some premium reports, you can input this rate of return yourself based on your account statement.

Investment Managers and Advisors

Investment managers are people and companies hired by you or your bank to manage your investments (RRSPs, TFSAs, etc.). They have training and years of experience in order to know where is best to invest your money.

Each investment fund manager (bank, brokers, etc.) has their own style of investment, which can be successful in some years and not as successful in others.

Mutual and Other Funds

Mutual funds are investments that have been established by management companies and require government approval in order to offer them to the public. They are highly diversified investments (investments in multiple industries to combat any market changes in one industry) and are professionally managed.

There are many different types of mutual funds and are usually considered special and specific to one area. For example, investing in Japanese company stocks would be a type of mutual fund offered by a fund manager.

Other special funds include:

- Pension Funds

- Endowments

- Other securities

The performance of each of these funds varies widely and no one fund is guaranteed to always produce the best return on your investment.

Mutual Funds usually have lower fees associated with them than a typical investment fund.

Pension Funds, a special type of investment, would have the lowest fees associated.

Fees for Investment Management

All financial advisors and investment managers charge a fee for their services. This is how they get paid for providing expertise and knowledge in managing your funds. You may pay this amount through an account fee or transaction fee, but most of the time you will be paying through Management Expenses. Management and Operating expenses are represented by a percentage (ratio) that is better known as the Management Expense Ratio.

Management Expense Ratio (MER)

This ratio represents the cost of your account to the investing company. It is an allocation of expenses to your account, then turned into a percentage to best show if your account and investments are profitable.

The expenses most commonly included in MERs are:

- Salaries for managers

- Overhead costs (building rent, utilities, day-to-day expenses)

- Commissions

- Bonuses

Most investments are represented in units and are assigned a value. If you add more money to the account, this will be shown as purchasing new units. Any account profit or loss will be shown as a change to the unit value not the units themselves.

Typically, MERs range from 2 – 3% of your account per year for a mutual fund but can be higher if you are paying a large commission to your broker. A Pension fund MER will typically range from 0.50% to 1.00% of your account per year.

This fee is deducted off your return percentage for the year. This means two things:

- This fee is hidden from you. Because your annual return is reported to you after these fees are taken off, you won't clearly know what you are paying in fees.

- If your return is negative, you don't have a profitable investment. If your return is negative, that means that it either costs more to run your account than it is making in return, or your investments have lost money. Consider a new investment strategy.

BenFlex Services fees range from 1.0% to 2.0% per year which includes custom services such as retirement and financial planning at no additional cost for clients with investment accounts over $50,000.

How to Choose an Investment Manager and Advisor

The following characteristics should be considered when hiring an investment advisor who in turn will offer their suite of investment funds:

- Disclosure of all fees and service costs. Fees, commissions and service costs can occur at the front-end (the time of purchase), while investing, and at the back-end (the time of sale). Ensure that whoever you invest with is transparent about their fees.

- Ability to understand the purpose of the investment. Understanding what you need this money for, retirement or a home purchase for example, is key to ensuring an investment strategy that will meet the required objectives.

- Ability to offer other services. Since you are paying fees to your manager or advisor, you should also consider what other services are available. Services such as estate planning or retirement planning could be more helpful than the money you gain.

- Ability to sympathize with the client. Someone who takes the time to get to know you and create a relationship with you is key with any investment. This will mean that they care about helping you and ultimately, they will make better decisions on your behalf. It is very rare to find someone in this category, particularly at a bank.

You want to make sure that whoever you give your hard-earned money to will understand you, your goals and help you in every way they can.

Choosing an Investment Fund or Strategy

Developing an investment strategy and selecting an investment fund depends on three key questions.

| What will the investment be used for? |

When will I need the money? |

How do I want to be paid? |

| This will help you and your investment manager understand your goals and objectives. |

This will help to understand your timeline and how aggressive you need to or can be. |

This will limit the type of fund available depending on if you want monthly payments or the money all at once. |

| For example, Retirement income or Home-purchase deposit |

For example, Retirement in 40 years versus Home-purchase in 2 years |

For example, A retirement fund would be spread out monthly, whereas a deposit for a home would need to be a one-time payout |

If you are putting money into the fund regularly, this can also make a difference to the investment strategy.

Your tolerance for risk is also key to any investment. If you are likely to worry about investment losses, you are risk adverse and should invest in a low-risk fund. If you are more likely to accept that losses will occur from time to time, then you are risk accepting and can invest in a higher risk fund. Different funds will have different risk levels which should be taken into consideration with your comfort level and your timeline.

You want to develop a detailed and in-depth financial plan with your advisor, rather than 'What will make me the most money?'

Comparison of Investment Funds - Detailed

See below for a look at some real-life funds and their rates of return.

Typical Balanced Funds

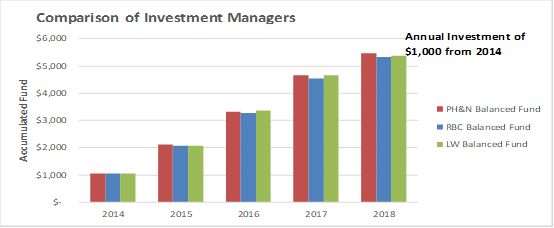

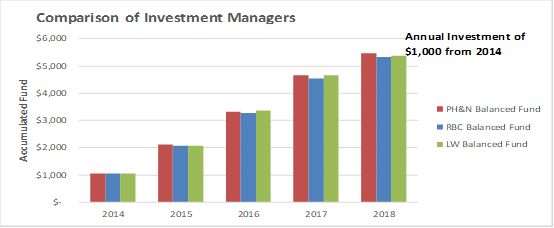

This chart compares the performance of a typical balanced fund with bank funds (RBC) and two Vancouver-based investment managers (Phillips Hager & North and Leith Wheeler):

Different Types of Investments

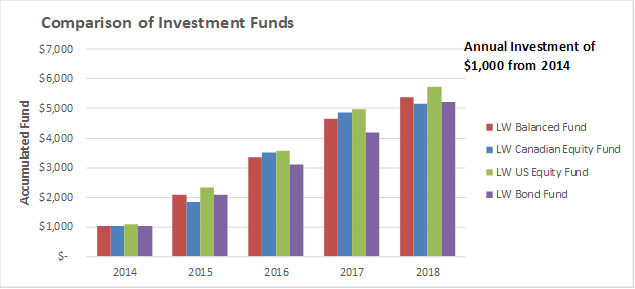

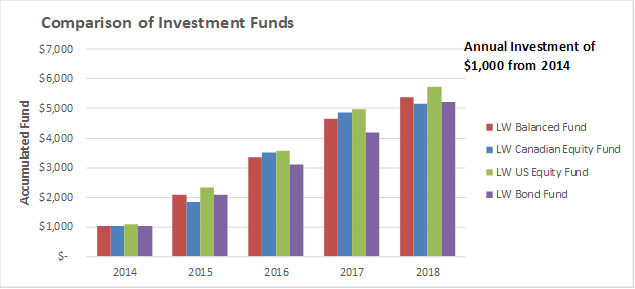

This chart compares the performance of the different types of investments for a single manager to show how volatile some investments can be:

You should note that the rates of return are highly dependent upon the period of measurement. While US equities have outperformed most other investments over the last 10 years, in the previous 10 years this was not the case. While Canadian equities may not provide higher returns than foreign or US equities over any reasonable period, they are less volatile and the risk of negative returns over any period of over 2 years is highly unlikely based on past performance.